Best Opportunity Zone Funds To Invest In

For instance if an Opportunity Zone Fund acquires existing real property in an Opportunity Zone for 1 million the fund has 30 months to invest an additional 1 million for improvements to that property in order to qualify for this program. West Oakland Uptown Jingletown and Coliseum Industrial.

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

Get Results from 6 Engines at Once.

Best opportunity zone funds to invest in. Substantial improvement requires improvements equal to the Opportunity Zone Funds initial investment into the existing property over a 30-month period. Some examples of institutional quality behemoth funds based locally in Los Angeles are Griffin Capital OZ Fund which is working on developing thousands of multifamily units in some of the. Here is a List of Qualified Opportunity Zone Funds compiled by the QOZ Marketplace as of March 9th 2021 IMPORTANT.

In most cases you must be a qualified or accredited investor to purchase shares in an opportunity fund. Fundrise 1 for example published its list of the top 10 Opportunity Zones in the country with more immediate growth potential. Only funds marked CERTIFIED have been certified by the Opportunity Zones AuthorityClick on the Fund Name to get more details on that particular fund.

Get Results from 6 Engines at Once. To qualify for the full tax break that QOZ investments offer participants must harvest their capital gains and reinvest them in a Qualified Opportunity Zone Fund by the last day of 2019. The IRS has formalized the rules the money has been flowing into qualified opportunity funds QOFs in a growing torrent and the time is drawing near --.

Maxus Opportunity Fund I. The Benefits of Investing in Opportunity Zones. 1 Million Investment from Erie Insurance Brings Growth to Opportunity Zone Business From Homeless to Opportunity Zone Developer with Terrica Lynn Smith Industrial Development Coming to Mesa Arizona Opportunity Zone.

In general an OZ fund must invest at least 90 of its assets in businesses located within a qualified opportunity zone. You can defer capital gains taxes and qualify for a step-up in basis depending on how long the QOZ investment is held. Midas Opportunity Zone Fund.

According to Messing it made sense for Skybridge to offer an opportunity zone fund because the firm focuses on reducing volatility for investors. Besides helping distressed communities get the appropriate economic stimulus QOZ Funds also offer many tax benefits to investors. Several Opportunity Funds and organizations have produced their top picks for Opportunity Zones.

Manus Bio Opportunity Zone Fund I. Many kinds of businesses qualify under the current guidelines but a few. Downtown and South Los Angeles.

Real estate investment trusts are an allowable legal structure for opportunity zone funds so REITs will gain more advantage by investing in opportunity zone properties. Cresset Capital has recently partnered with a real estate investing firm to provide Opportunity Funds across all the United States. Local Grown Salads Baltimore Opportunity Zone Fund.

McGregor Interests Council Bluffs QOF LLC. Ad Search Us Invest. Ad Search Us Invest.

Though the savings on capital gains will diminish slightly after this deadline investors can still reap considerable tax benefits from the program going forward but must invest capital gains in a QOF within 180 days of. The top of the list found Gowanus in South Brooklyn going from having only 03 of households earning over 200000 in 2000 to 216 of households reaching that level 17 years later. The investment options include real estate development re-development and private company investments.

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

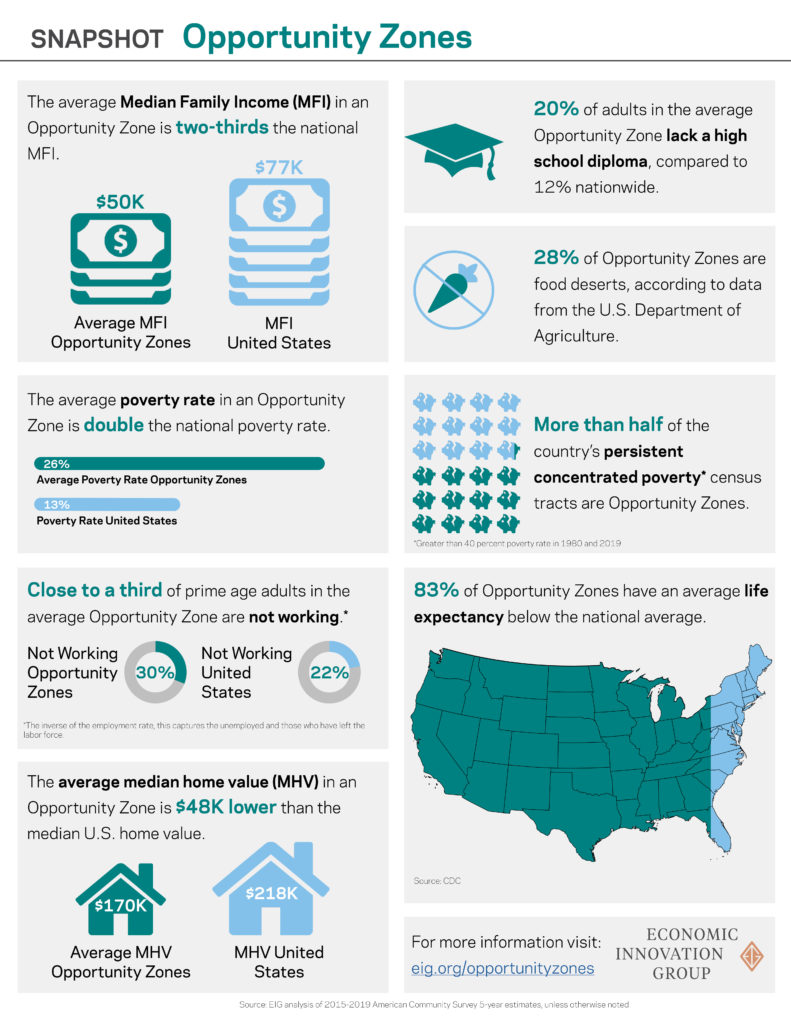

Opportunity Zones Facts And Figures Economic Innovation Group

Opportunity Zones Facts And Figures Economic Innovation Group