Healthcare Services Investment Banking

Med devices and med tech. Have deep sector knowledge built over years of focused industry coverage and our team focuses exclusively on its health care services clients.

What Is Investment Banking Definition Careers Salary

I know GS and Centerview do a lot of pharma Morgan Stanley has strong Services Gugg great Med Devices what about firms like JP BAML Evercore Laz PJT Citi Barclays Guggenheim Credit suisse.

Healthcare services investment banking. In healthcare IB bankers advise companies in the biotech pharmaceutical medical device healthcare servicefacility and healthcare IT markets on mergers acquisitions and debt and equity capital issuances. Today the healthcare services sector is under unrelenting cost pressures while. We work collaboratively with a wide range of organizations including private for-profit companies.

The award-winning Piper Sandler healthcare investment banking division provides expertise in mergers and acquisitions capital markets and private placements. The lines between payors facilities providers pharmacies and distributors are blurring as value-based care models are implemented facilitated by technology. Following Q1 2020 there were three Health Services sectors that had increases in deal value.

Responsible for providing client relationship management and investment banking services including strategic advisory services to corporate and private equity clients related to buyside and sellside MA debt and equity capital raising designated by industrysector specifically within the Healthcare Services sector. Edgemont Partners is a premier healthcare investment bank that provides merger and acquisition advisory and growth capital raising services exclusively for healthcare companies. In terms of domain expertise dedicated resources and track record.

Our team regularly advises public and private healthcare companies and care providers with a complete range of investment banking valuation and dispute-related services including mergers and acquisitions private capital raising fairness opinions legal matters restructurings and healthcare management. Platform the group is expanding into Europe to enhance its ability to. We have built a leading franchise helping healthcare companies maximize the value of their businesses.

With seasoned healthcare-focused banking professionals in Boston New York and San Francisco we collaborate with clients to. Two other healthcare players are the investment banks Guggenheim Partners and Greenhill Co. Healthcare leaders who want to capitalize on rapid changes in science regulation technology and therapeutics benefit from the expertise of investment banking advisors with relevant experience and a.

Physician Medical Groups saw an increase of 6 Hospitals increased by 11 and Behavioral Care had a substantial 900 increase in deal value due to the 12 billion LifeStance Health. Also which of these Healthcare groups have the best exits to HC. Healthcare Investment Banking Managed through Cain Brothers a division of KeyBanc Capital Markets.

Keeping the pace is the Health Care Investment Banking group of Raymond James one of the oldest largest and most successful health care-focused advisory services practices in the US. Leveraging BTIGs full resources our Healthcare Investment Banking Group works alongside established and emerging private and public healthcare companies to help them grow and capitalize on valuable market opportunities. One that has for many years been near the top is global investment bank Jefferies.

Health care investment banking team focused on MA. Investment Banking Services Our Team Conferences and Events Sector Coverage. Healthcare is experiencing fundamental change in the form of evolving delivery and reimbursement models.

Health care investment banking team focused on MA debt and equity private placement for profit and not-for-profit entities. KeyBank provides comprehensive financial solutions for your healthcare organization including. With deep domain expertise exceptional execution and incomparable integrity we go beyond the fundamentals to secure the greatest value and optimal overall terms for your company.

In 2020 we increased our firmwide investment in technology to 12 billion 2 to deliver these enhanced digital capabilities. Since day one weve focused solely on providing expert strategic advice and transaction execution bringing a steadfast commitment to our clients driven always by whats in their best interest. Healthcare is one of the most dynamic and complex areas in the global economy.

Healthcare Real Estate Explore our recent deals in the complex area of REITs hospitals and senior housing. Which investment banks are strongest in services IT. Auctus Capital Partners has deep domain expertise in the Healthcare and Life Sciences industry.

We design deliver and customize agile banking platforms to speed payments improve cash flow and modernize back-office operations. Less interested in pharma. Healthcare Investment Banking Definition.

Healthcare investment banking at William Blair draws on the firms deep expertise and relationships throughout the sector to deliver objective advice and execution excellence. Edgemont Partners is a premier healthcare investment bank that provides merger and acquisition advisory and growth capital raising services exclusively for healthcare companies. Co-Founder Managing Director.

Banking Industry 2021 Overview Trends Analysis Of Banking Sector

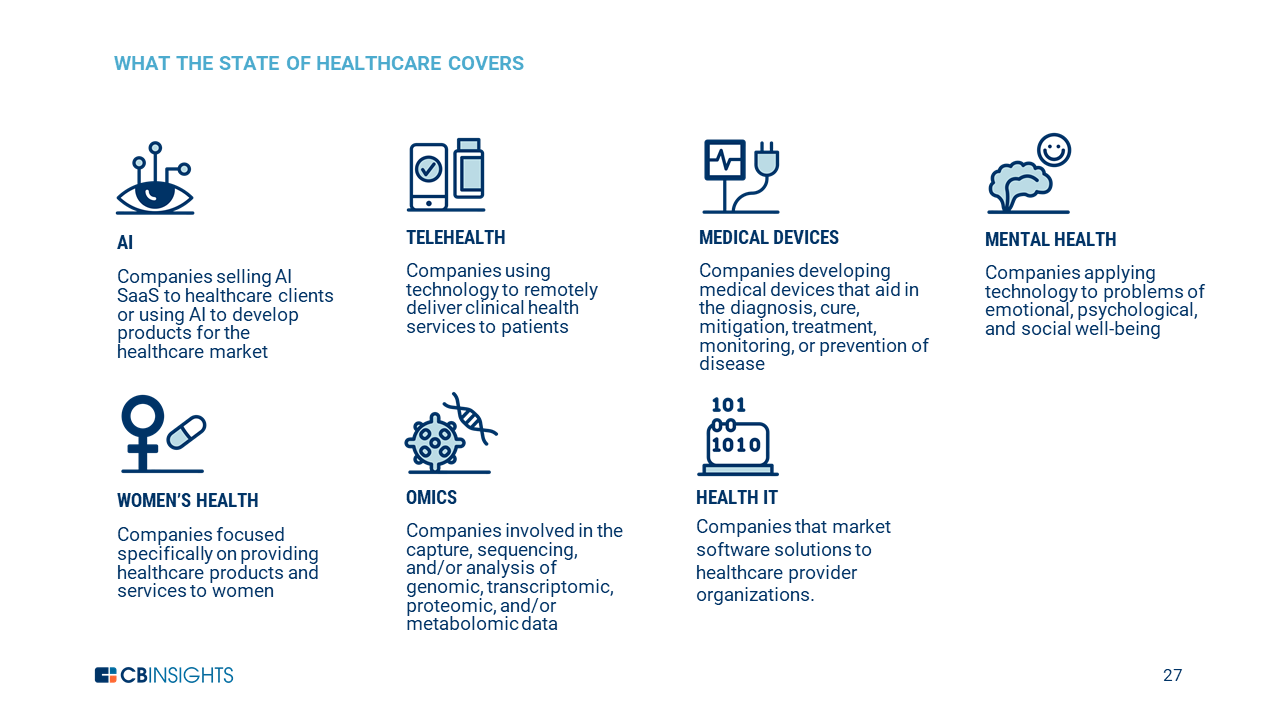

State Of Healthcare Q1 21 Report Investment Sector Trends To Watch Cb Insights Research

Healthcare Industry In India Indian Healthcare Sector Services

Https Www Isdb Org Sites Default Files Media Documents 2020 02 Health 20sector 20policy Pdf