Tiaa Investment Options

1 Guarantees are subject to the claims-paying ability of the issuing insurance company. Many upcoming retirees who have TIAA encounter confusion about how the TIAA Traditional Annuity option works and in particular how it works when you want to take your money out.

Tiaa Vs Vanguard Two Long Term Investing Options Biltwealth

- The website features interactive content throughout the site and helps investors zero in on what is financially prudent at each life stage.

Tiaa investment options. State ORP investment options at TIAA The current investment lineup at TIAA is on the left and the new investment lineup effective with the new contract beginning January 1 2021 is on the right. Balance less riskpotential growth. NEW YORK Oct.

Real estate provides direct investment exposure to commercial properties. An account can be opened with zero deposit. TIAA Access investment choices.

TIAA Personal Portfolio is a solid option for investors looking to engage in socially conscious investing through a financial institution with a long and stable history. Option trades now also carry a 0 per-contract charge. As a result any money you invest is guaranteed to still be around with interest once its time to withdraw for retirement.

Fixed Income primarily invests in corporate andor government bonds certificates of deposit and money market securities. By the 90s TIAA offers its customers a socially responsible investment option called CREF Social Choice Account. The investment options that will be removed are in red and the new investment options are in green.

TIAA Traditional is a guaranteed insurance contract and not an investment for federal securities law purposes. Investment insurance and annuity products are not FDIC insured are not bank guaranteed are not deposits are not insured by any federal government agency are not a condition to any banking service or activity and may lose value. Money markets hold short-term investments that could include government-issued securities and certificates of deposits.

Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America TIAA and College Retirement Equities Fund CREF New York NY. TIAA Traditional is a guaranteed insurance contract and not an investment for federal securities law purposes. Investment options that are moving to a new share class Investment option on the left side of the chart offered through the DePaul Retirement Plan at TIAA will continue to be available at Fidelity but will transfer to a different share class on July 22 2021.

See the range what is available and learn about your options. The TIAA Traditional Retirement Annuity is the flagship retirement savings product at TIAA. Investment insurance and annuity products are not FDIC insured are not bank guaranteed are not deposits are not insured by any federal government agency are not a condition to any banking service or activity and may lose value.

Some investment options will no longer be available under the new contract. With up to 64 mutual funds from TIAA and other money managers you can diversify your investments to help pursue your goals. It is a fixed annuity meaning it garners returns based on a predetermined interest rate thats set by TIAA.

TIAA Pros - The minimum investment amount for NTF mutual funds can be as low as 500. All TIAA Personal Portfolio options require a 5000 minimum investment amount and charge a 30 of assets under management fee. Morningstar portfolio 2 Pre-built risk-based portfolios that allow you to choose your management style active or passive and risk tolerance.

Target date fund Select a fund closest to your retirement date and the fund automatically adjusts over time. The advisory 030 fee is levied as a percent of your total AUM and is charged quarterly in arrears. 1 2020 PRNewswire -- TIAA significantly expanded the investment options available in the TIAA Access variable annuity 1 lineup.

SIPC only protects customers securities and cash held in brokerage accounts. Each is solely responsible for its own financial condition and contractual obligations. Investment options that are changing.

Transferring an account via the ACAT system costs 50. To see performance click here. Updated May 10 2021 Most people working in the public education system have access to TIAA investment options within their employer-sponsored plan.

Stock and ETF trades are 0 each. TIAA currently offers diverse products available in investing borrowing home purchase refinance home equity line of credit and banking. Youre seeking long-term growth to help beat inflation and are willing to take on some risk to do so.

- The website is great for people new to investing with quizzes charts graphs bullet points testimonials and more. TIAA provides a range of retirement products beyond those listed here. Youre seeking long-term growth and are willing to tolerate some risk to pursue medium growth over time.

Closing some IRAs can cost 130. TIAA Investing Fees Account Minimums and Commissions TIAA charges nothing for opening maintaining or closing a taxable account.

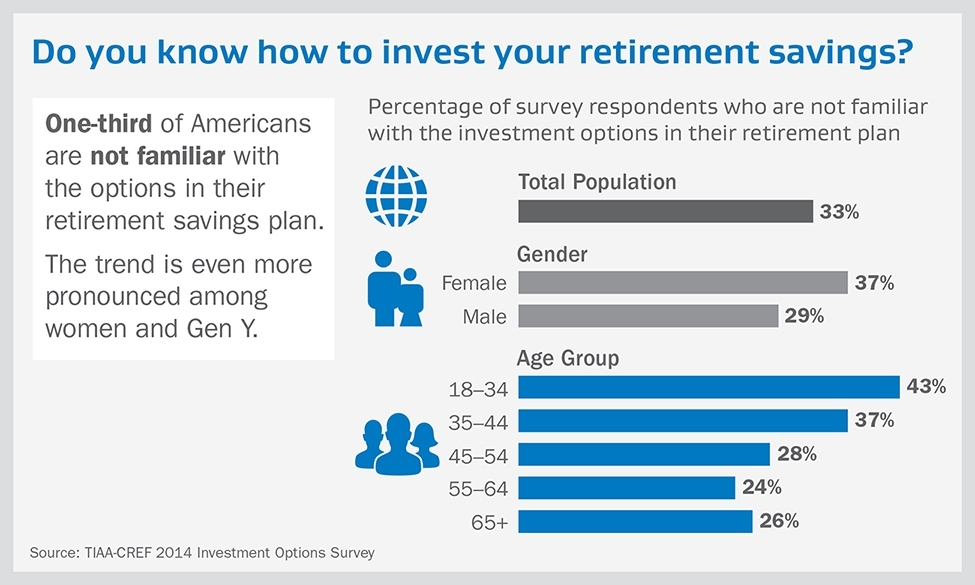

Tiaa Cref Survey One Third Of Americans Are Not Familiar With Their Retirement Plan Investment Options Business Wire

Https Www Tiaa Org Public Pdf Obiee 405467 Plan Related Info Pdf

Https Www Tiaa Org Public Pdf Wmich Brokerageguide Pdf

Tiaa Public Still The Same Company Were Dedicated