Greenlight Card Investing

It is a debit card that parents load allowance money among other funds from the Greenlight app onto the kids debit card. Investing involves risk and may include the loss of capital.

Greenlight Max Investment Accounts For Kids

Investing involves risk and may include the loss of capital.

Greenlight card investing. Greenlight a startup that offers debit cards and investing for kids has raised a 260 million Series D at a valuation of 23 billion. 2021 Greenlight Investment Advisors LLC an SEC Registered Investment Advisor provides investment advisory services to its clients. By providing a simple way for parents to track their childrens personal finances the app encourages children to develop practical and lifelong financial habits.

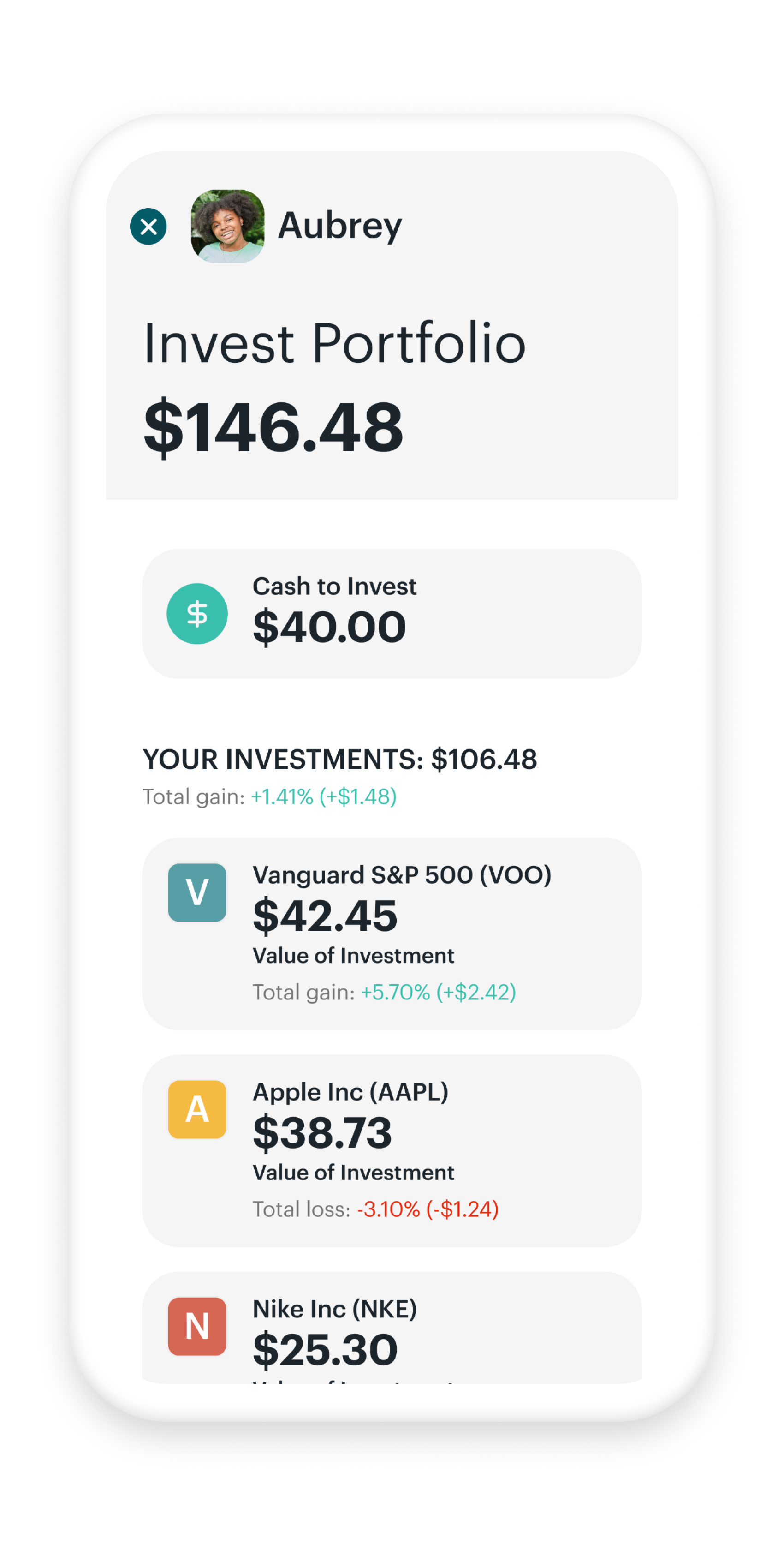

To invest youll need to upgrade to one of our investing plans. Families on all Greenlight plans have access to research available stocks and ETFs. Kids receive a debit card and can save for college earn an allowance through chores invest in stocks set direct deposit and more.

The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International. Click on the Investing tile within the Child Dashboard Under the Investment Options section of the Invest dashboard click on Company Stocks or Exchange Traded Funds. Greenlight Invest 798mo or Greenlight Max 998mo.

Greenlight will not charge you any fees on your trades. In Summary Greenlight has truly revolutionized the way children spend save and invest. Investing involves risk and may include the.

The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International. The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International. The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International.

What makes investing with Greenlight different. 2021 Greenlight Investment Advisors LLC an SEC Registered Investment Advisor provides investment advisory services to its clients. Families on the Greenlight Max or Greenlight Invest plans have access to our investing platform designed just for kids.

Investing with Greenlight unlocks the world of investing for kids with parent approval on every trade. 2021 Greenlight Investment Advisors LLC GIA an SEC Registered Investment Advisor provides investment advisory services to its clients. Investing involves risk and may include the loss of capital.

Families with five kids or fewer pay a total of 499 per month for Greenlights core offeringsdebit card chores etcor up to 998 per month to include investing. Greenlight has established itself as a trusted family bank serving 3 million parents and kids with a 485 app store ranking and over 160000 reviews. The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International.

The Greenlight card is issued by Community Federal Savings Bank member FDIC pursuant to license by Mastercard International. Most people are not sure if Greenlight is a credit or debit card. Kids learn about the world of investing with their own Greenlight investor profiles while parents approve every trade.

2021 Greenlight Investment Advisors LLC GIA an SEC Registered Investment Advisor provides investment advisory services to its clients. Greenlight a startup which provides bank accounts and debit cards for kids raised 54 million from investors such as Wells Fargo and JPMorgan Chase. Families can also enjoy the investing features with the Greenlight Invest plan which costs 798 per month per family while Greenlights traditional banking plan is still 499 per month per family.

2021 Greenlight Investment Advisors LLC an SEC Registered Investment Advisor provides investment advisory services to its clients. This helps kids learn how to manage money using a debit card unlike using cash in their day-to-day spending. 2021 Greenlight Investment Advisors LLC an SEC Registered Investment Advisor provides investment advisory services to its clients.

GREENLIGHT INVEST 798month This plan gives your child ren all the benefits of the Greenlight debit card plus the ability to invest. Greenlight is a debit card. Families can research buy and monitor real stocks and funds all from the Greenlight app.

Investing involves risk and may include the loss of capital. Greenlights 3 million household customers pay subscription fees driving the bulk of revenue. Investing involves risk and may include the loss of capital.

Greenlight Max costs 998 per month per family with no transaction fees for investing and includes other upgraded options like cellphone purchase and identity theft protection. VentureBeat Homepage The Machine.

Greenlight Max Investment Accounts For Kids

Money Apps For Kids Teaching With Greenlight Max Centsai

This New Platform Is Teaching Kids Life Skills One Penny At A Time

With Debit Cards And Investing For Kids Fintech Startup Greenlight Doubles Valuation To 2 3 Billion